| Background Points for Today's Blog: (1) In discussing U.S. foreign oil dependency, two measures are used: (2) Under laws imposed after the Arab oil embargo of the 1970s, U.S. companies can export refined fuel such as gasoline and diesel but not crude oil itself. |

Typically when U.S. foreign oil dependency is being discussed in the Media, it will be the net imports number that is cited. Using this benchmark, the EIA states "In 2012, about 40% of the petroleum used by the United States was imported from foreign countries -- the lowest level since 1991". For 2013 (using non-finalized data from the EIA), estimated net imports were 33% -- the lowest level since 1986.

1 The above 2013 values are not official. In 2012 per the EIA, about 57% of the crude oil processed in U.S. refineries was imported.

Historical Perspective: The significance between gross versus net imports is a relatively recent development. For decades prior to the current boom in domestic oil production, yearly U.S. petroleum exports were very constant at approximately 5% of total supply. However, during the past 7 years, two things have dramatically changed:

bpd -- barrels per day.

|

| Gross Imports: | |||

| Exports | |||

| Net Imports |

In a world where all oil was the same (type and price), use of net imports would be totally appropriate. After all, this would be an example of American refining technology ingenuity where we import oil, refine and then export it into world markets better (lower costs) than anybody else. However, this isn't what's happening. Not all oil is the same type (light versus heavy crude) or priced the same (U.S. versus World oil prices).

Understanding Some Oil Basics 101: In long-term forecasts through 2040, the Department of Energy projects that U.S. dependency on imported oil (net imports) will stubbornly be above +30%.

Oil Production & Consumption:

With the exceptional increase in U.S. oil production from tight shale formations/fracking (e.g., North Dakota, Texas, etc.) there is good and bad news. Most of this oil is high quality light crude, relatively easy to refine in refineries that are not terribly complex. The bad news is many U.S. refineries (especially on the West Coast and Atlantic Seaboard) can not use this lighter oil. Prior to the shale boom, U.S. refiners spent billions of dollars to configure their plants for heavier and sour foreign oils (from Canada and OPEC countries of Venezuela, Saudi Arabia, and Iraq).

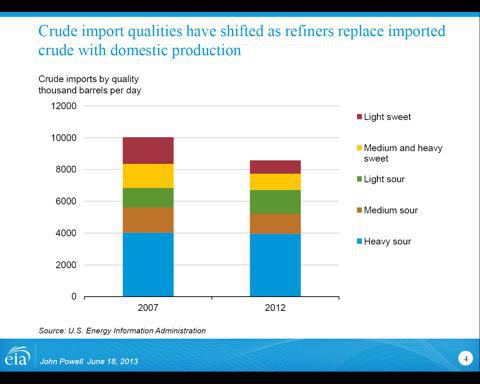

The below chart from the EIA illustrates this above point. While U.S. imports of light crudes have been reduced dramatically in recent years (displaced by new oil production from North Dakota, Texas, etc.), imports of heavy crudes have remained constant.

Digging Deeper into the Data: Contradictory to what is reported in the Media, OPEC (not Canada) remains the largest oil importer to the U.S. While statements that Canada is the largest crude oil importer is not a "pants on fire" misrepresentation -- it is "Spin Doctors" at work. Although it is again technically correct that Canada is the largest single country importer, this fails to recognize that OPEC (comprised of 12 countries) is a cartel and operates as a single entity.

(2013)  Importer to the U.S. | (2013)  Oil Refiner for the World. |

In addition to gasoline exports, a major growth market for U.S. refiners is diesel fuel (especially Europe and South America). A large number of European refining plants have closed, as they can not compete with U.S. produced diesel.

U.S. Petroleum Exports: As discussed in prior blogs, a major reason in the unprecedented surge in U.S. petroleum exports is the price difference between U.S. and Internationally traded crude oil.

U.S. (WTI) Versus International (Brent)

During the current U.S. oil boom, the benchmark price for domestic oil (West Texas Intermediate -- WTI) has been below the international benchmark for crude (Brent). As a result, many U.S. refineries have been using lower cost WTI priced oil, refining it (e.g., gasoline, diesel), and then pricing the refined products into international markets (where competing foreign refiners must pay the higher cost Brent price for crude oil).

Since it is legal for refined oil products to be exported, a refiner's access to lower cost domestic oil does not necessarily translate to cheaper gas for the U.S. driver and consumer. A U.S. refiner could as easily sell their product to the international market if that would maximize their profit. This explains why even with dramatic increases in domestic crude oil production (especially in the last 3 years), U.S. gasoline prices have basically remained unchanged.

2 As this Blog continues to point out, the current blending of ~10% ethanol in gasoline achieves well established health science benefits (lead removal, oxygenate for cleaner air).

Note: Notice that there are no major oil pipelines to the West Coast or Atlantic Seaboard.

Foreign Oil Imports: Using 20/20 hindsight, the crystal ball of many U.S. refiners (on the West Coast and Atlantic Seaboard) was not very good. They did not foresee the magnitude of the current domestic oil boom coming -- investing billions to configure their refineries to use foreign heavy oil. These refineries are simply not going to walk away from this capital investment and re-configure their plants yet again to use domestic light crude in making gasoline.

Refined Products Exports: Many U.S. Refiners (along the Gulf Coast) use lower cost domestic oil (WTI), but price their products (gasoline, diesel) into an international gasoline and diesel market based heavily on more expensive Brent. The cheaper WTI becomes in relation to Brent, U.S. refiners make more profits and increase world market share.

Related News Stories:

U.S. Oil Boom Drives Gasoline & Diesel Exports -- (Fox Business News).

Impact of Lifting Ban on U.S. Crude Oil Exports -- (Wall St. Journal).

World Refinery Margins -- (BP Energy Outlook).

Technical Chemical Engineering Discussion: Why U.S. Gasoline Refiners use so much Imported Heavy Oil

Where the U.S. got its oil in 2015 -- (Fortune Magazine, Robert Rapier).

JGHG5CK4C5MZ

No comments:

Post a Comment